As though we haven’t heard this plea enough, it’s time for sellers to let go of unrealistic expectations. There are too many people who are testing the market and aren’t serious about selling their homes and many of them forget that they aren’t the only one taking the hit. When we list your home, our job is to market the home. We will put it on the market for SALE, not for tour, not for show…for SALE. Right now, more than ever, price is driving the sale of the home.

As though we haven’t heard this plea enough, it’s time for sellers to let go of unrealistic expectations. There are too many people who are testing the market and aren’t serious about selling their homes and many of them forget that they aren’t the only one taking the hit. When we list your home, our job is to market the home. We will put it on the market for SALE, not for tour, not for show…for SALE. Right now, more than ever, price is driving the sale of the home.

My goal as your Realtor is to analyze the market in your area and help you determine what the most realistic asking price for your home should be. It’s up to you to set the price. It’s up to me to point you in the right direction.

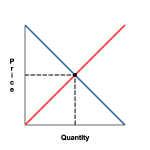

Supply and demand are the two opposing forces that are intertwined in the process of determining the right price. Typically, when you increase the supply, provided that it is not a response to increased demand, the price of the item falls. There’s more of it, so the consumers have more choices, and they can afford to shop for a lower price. If you decrease the supply, as long as it’s not in response to changing demand, the prices tend to go up because there are more buyers than there are items for sale. (To read my quick article describing supply and demand, please click here)

Is it possible to artificially affect pricing without affecting the supply? Yes, but it requires artificially altering consumer demand by offering incentives or specials, or conveying a sense of urgency for the buyer.

Is it possible to artificially affect demand by changing the price? Yes. How? Lower the price. If you offered a gallon of gas at 50% of the surrounding competition’s prices, you’d artificially increase demand for gas in that area. The problem with this is that the gas station won’t make any money, so lowering the price too much is not in their best interest.

Is it possible to increase the value of a product by artificially inflating the price? In other words, if I want to sell my peanut butter for $1.00 more than all of the competition, will that increase demand for my product? Will it increase demand for the product that’s $1.00 cheaper? No, and no. Increasing the price of a product that is competing against less expensive products is not going to increase demand for higher prices.

Is it possible to increase the value of a product by artificially inflating the price? In other words, if I want to sell my peanut butter for $1.00 more than all of the competition, will that increase demand for my product? Will it increase demand for the product that’s $1.00 cheaper? No, and no. Increasing the price of a product that is competing against less expensive products is not going to increase demand for higher prices.

It is our job to get the highest price that we can for your home. We cannot do this by pricing your home higher than the competition, no matter what the condition of the home. Even if the home has upgrades, the price you set may be too high for the area to bear.

In order to sell a product to a consumer, the price must be right.  Your neighborhood is like a grocery store filled with products. Those products are homes. When you shop in the grocery store, you look for the best products at the lowest price. Sometimes you pay more for a better product because it has 10% more!!! Sometimes you pay more because of the brand name. Sometimes you settle for bargain basement prices because name brand aspirin is the same as the local grocery store aspirin, and you just don’t care. But, if you find a product that is clearly over priced, it is guaranteed that you’ll pass it by with only a glance.

Your neighborhood is like a grocery store filled with products. Those products are homes. When you shop in the grocery store, you look for the best products at the lowest price. Sometimes you pay more for a better product because it has 10% more!!! Sometimes you pay more because of the brand name. Sometimes you settle for bargain basement prices because name brand aspirin is the same as the local grocery store aspirin, and you just don’t care. But, if you find a product that is clearly over priced, it is guaranteed that you’ll pass it by with only a glance.

Manufacturers spend millions of dollars every year to market these products to you. Realtors also spend their money on your home to make sure that it is marketed as effectively as possible. If you, the seller, set a price that is too high, you may generate interest in the product simply because it’s on the same block as more realistically priced homes, but nobody will buy it, especially when three other identical products down the street sold at a price far lower than yours.

“But our house is upgraded.”

There is a very clear difference between a home that is upgraded and a home that simply has new features that are already expected. Is it really upgraded, or is it just more sellable? Just because a fixture is new, or tile has been laid doesn’t mean that you have a home with upgrades. What it does mean is that you have a clean home. What makes those items upgrades? The quality of the items. New linoleum is still linoleum. It doesn’t increase the value of your home nor will it command a dollar for dollar investment recovery at sale. A pool is a great feature to have, but what type of pool is it? Is it a pool that most people expect, with a diving board and/or decorative rocks surrounding the perimeter, or is it an enlarged spa? In Arizona, in the 200-300K price range, a pool adds about $5,000 in value. Sometimes more, sometimes less. This really depends on how many homes in your sub-division have pools. In some countries, as you can see in the illustration, pools are in very high demand.

There is a very clear difference between a home that is upgraded and a home that simply has new features that are already expected. Is it really upgraded, or is it just more sellable? Just because a fixture is new, or tile has been laid doesn’t mean that you have a home with upgrades. What it does mean is that you have a clean home. What makes those items upgrades? The quality of the items. New linoleum is still linoleum. It doesn’t increase the value of your home nor will it command a dollar for dollar investment recovery at sale. A pool is a great feature to have, but what type of pool is it? Is it a pool that most people expect, with a diving board and/or decorative rocks surrounding the perimeter, or is it an enlarged spa? In Arizona, in the 200-300K price range, a pool adds about $5,000 in value. Sometimes more, sometimes less. This really depends on how many homes in your sub-division have pools. In some countries, as you can see in the illustration, pools are in very high demand.

Paint is not an upgrade. An air conditioner just like the neighbor’s is not an upgrade, even if it was installed yesterday. Sure, it’s new, and that may influence whether or not someone will consider your property, but it will not support a higher price. It is a deferred maintenance item. An air conditioner twice the size of the surrounding neighborhood could be considered an upgrade, unless you’ve upgraded yourself out of the market.

Basically, anything that is expected to be in a standard single family home in the 200K – 300K range will only add to the sellability of the home, not the value.

Be careful when you spend money on your home, because some items don’t fit. A 6-Burner Viking Gas Stove in a 300K Home with Corian counter tops and laminate floors won’t increase the value of your home. It will make it sell faster, true, but you won’t recover your costs. Nobody expects there to be that high of an upgraded item in your home. Consider upgrades to be vast improvements over not just the condition of the previous item, but also the quality. The items you perceive to be upgrades may only be what you believe to be upgrades and the rest of the world may expect more.

The Bottom Line

Your house has an inherent value to someone. Until the home closes escrow, your home’s value is basically unknown. What you do know is:

- How much others have paid for similar homes, recently.

- How much you paid for your home.

- How much money you put into your home.

- How much you still owe.

The average return on Real Property is around 4% annually. 2005 really screwed up homeowner’s perception of value in housing. If you purchased your home in 2003 for $150,000.00, and you apply the average rate of return, a realistic price for your home in 2008 would be about $185,000.00 give or take. That’s $7,000 per year in value, and it’s realistic. If your neighborhood comparables show that properties just like yours are selling in the $220,000 range, then your return is HUGE and you need to realize that it’s completely abnormal. Many homeowners screwed up by tapping into that artificially bloated equity to upgrade their homes or buy other properties or a boat or other luxury item. Now, they think they can recover it, and they can’t.

Let’s just hope that Sellers will become more realistic about looking at how much value they have gained already and consider it a blessing, and to not be greedy. If you are thinking about selling your property, and you thought it was worth more than it actually is, think again about your reasons for selling. If you must sell, get realistic about the price and sell. The offers are there and there are plenty of hungry buyers. If you don’t have to sell, hold the property or rent it out and take a small monthly hit for a while. You’ll benefit from it in the long run.

If you have no idea whether or not you’re in the right position to sell your home, give me a call at (602) 312-3262 and I’ll be happy to work up a Market Analysis of your home so you can make the right decision. When you’re ready to list your property, know that I will take care of you through the entire process and in the most cutting edge ways.

I hope to hear from you.