Every short sale needs a pricing plan. Every home on the market needs a pricing plan. In any market, it’s in the best interest of the home owner to sell the home for the highest possible amount. In a distressed market, with a distressed property, sometimes there isn’t enough time to “hope” for a higher price than the home will bring. Knowing that, it becomes critical to the life of the listing to have a scheduled price reduction plan.

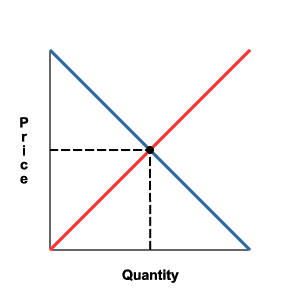

Every short sale that I have listed has received an offer, because I implement a pricing plan, depending on the amount of time left before foreclosure, which prices the home slightly above market value, then systematically reduces over time at regular intervals. When the price reaches market value or below, it will most likely draw an offer, and as a result of the planning, enough data has been captured to make a solid case to the lender that no higher offer is possible. This is all driven by supply and demand.

It’s very important to illustrate to the banks (because they have no idea about real estate) the gradual increase in showings over time as the price is slowly reduced on a schedule. When we can show a lender that an over-priced home is receiving no showings, yet when we reduce the price, the number of showings increase, we make a good case for the offering when it comes.