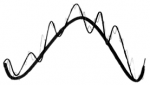

For years and years the real estate market has been up and down, up and down, a cycle that repeats itself every 7 to 14 years on average. SEVEN TO FOURTEEN YEARS!!! That’s long enough to start a family and have kids in elementary school AND high school. Remember how long 4 years was when you were young?

For years and years the real estate market has been up and down, up and down, a cycle that repeats itself every 7 to 14 years on average. SEVEN TO FOURTEEN YEARS!!! That’s long enough to start a family and have kids in elementary school AND high school. Remember how long 4 years was when you were young?

Are you renting? Are you living at home, just out of college? Consider your options now because time is running out. You don’t want to be someone who’s looking back

What is the market condition?

Today, the market is in distress. We experienced unnatural gains in 2005 and as a result, we had our second bubble of the new millennium. The first bubble was the outlandish condition of the stock market, a market where people invested in ideas, not in solid products. The second bubble was the same but with homes. People investing in ideas like. The idea that you could purchase a home for $100,000 and sell it for $200,000. Some people were lucky enough to buy at the right time and sell at the right time, but nobody knew it was going to go down the way it has.

Today, the market is in distress. We experienced unnatural gains in 2005 and as a result, we had our second bubble of the new millennium. The first bubble was the outlandish condition of the stock market, a market where people invested in ideas, not in solid products. The second bubble was the same but with homes. People investing in ideas like. The idea that you could purchase a home for $100,000 and sell it for $200,000. Some people were lucky enough to buy at the right time and sell at the right time, but nobody knew it was going to go down the way it has.

What do I mean when I say that the market is in distress? In 2003, people were buying homes on adjustable rate mortgages because the interest rates were so low. In 2005 as people saw the prices of real estate skyrocket, they did one of two things. They either sold their property, or they pulled money out on interest only loans with adjustable rates to buy cars, boats, other homes (bad timing,) you name it. A remodeling and new builds went nuts. Those who sold probably had a legitimate reason to sell and weren’t doing it because they were fearful of a market bubble bursting. Most of us asked the same question: “If I sell now, where am I going to go?” Read more about retirement investing at https://moneypacers.com Your Guide To Financial Stability .

Here’s why there is so much distress. Those adjustable rate mortgages were typically 5 years fixed, then adjustable after that. If you purchased your home in 2003 on an adjustable rate mortgage, then you pulled money out of your house for who knows what, you are probably experiencing hard times now because your mortgage has expired and has adjusted by around 2 points, and now you can’t afford your payment. To top it off, your home is worth less than you owe the bank and you can’t pay. Foreclosure is imminent, you must sell short.

Here’s why there is so much distress. Those adjustable rate mortgages were typically 5 years fixed, then adjustable after that. If you purchased your home in 2003 on an adjustable rate mortgage, then you pulled money out of your house for who knows what, you are probably experiencing hard times now because your mortgage has expired and has adjusted by around 2 points, and now you can’t afford your payment. To top it off, your home is worth less than you owe the bank and you can’t pay. Foreclosure is imminent, you must sell short.

Think of Owning as a Long Term Proposition

Before you own, understand that you need to come to terms with the way the market swings. If you play the stock market and you have been successful trading short term trades, then perhaps you’ll do well managing real estate the same way, but if you cannot handle the swings, don’t buy real estate. Buying today means owning for a longer time.

Owning a home builds long term wealth. As you pay your mortgage, every month a little more of that house becomes yours. Every year, on average, the value of your investment increases. History shows that the market always increases over time, barring natural disaster or other completely unexpected anomalies. Scottsdale is quite solid in its growth history.

What Does the Future Hold?

Nobody knows. Isn’t that comforting. The only thing we see are patterns, and right now, the patterns of the past tell us that even though our circumstances are unique compared to other times the market has been in distress, we are not spiraling towards our doom. In 2008, the number of homes sold has increased. In 2008, the number of foreclosed properties has increased. By the end of 2009, when we have a new president in office, and people have cooled down, and interest rates have begun to climb, consumers will be more confident about spending, and more money will be invested in long term real estate holdings.

Nobody knows. Isn’t that comforting. The only thing we see are patterns, and right now, the patterns of the past tell us that even though our circumstances are unique compared to other times the market has been in distress, we are not spiraling towards our doom. In 2008, the number of homes sold has increased. In 2008, the number of foreclosed properties has increased. By the end of 2009, when we have a new president in office, and people have cooled down, and interest rates have begun to climb, consumers will be more confident about spending, and more money will be invested in long term real estate holdings.

If you find yourself watching this come true and you haven’t purchased your first home by then, it will be too late.

If you find yourself watching this come true and you haven’t purchased your first home by then, it will be too late.

Start looking today. Downpayment Assistance is going away. Think about ownership rather than preference. Buy something! Find a home that might not be ideal and start building ownership so you can look back in 10 years and say, “Thank you…I am so glad you helped me begin building my wealth when you did, because I would have missed out.”