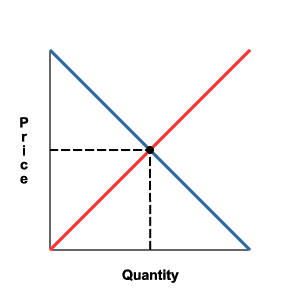

Supply and demand is a powerful economic force that has many dynamic variables that affect consumers and suppliers.

When it comes to selling a home, ultimately, it comes down to the price. There’s a supply of homes on the market, each supplied by a single owner (for the most part) and represented by a myriad of brokerages competing to be the best at what they do.

It’s different than a company that produces the same product over and over again. Create a widget, and the number of widgets compared to the number of widgets demanded plays a huge role in determining market value of that widget. Please go and read stockpair review at gobinaryoptions.net.

Real estate is different, however. In a widget store, the location of the widget doesn’t affect the retail price of the widget. In real estate, one builder could build the same house in two different locations and the demand will be for the location before the house itself.

This is not always true, but is for the most part.

When you ask more than the market will bear, in consideration of the competing properties and their show quality, you’ll have a hard time selling. When you price a property just right, you tend to sell it much faster than the competition. Often it doesn’t matter what you’re buying so much as it matters where you’re buying it. Any home can be remodeled to maximize its value in its location. Tear it down, re-build.